2015.07.26 Update: the project is currently having financial difficulties - it is not recommended for anyone to enter right now - at least until we hear news that people are able to withdraw their money without issues. If you are having trouble getting your money out now - you may find this post useful.

Peer-to-peer lending - what a great idea. Lenders and borrowers are matched to each other in a social network, cutting out the middle man in the form of a banking institution. Lenders are gaining more, borrowers are paying less. In today's world where crowdsourcing is becoming increasingly popular - where you can get a ride through a service like Uber and save on a taxi fare, or get a room through AirBnB, instead of a hotel, peer-to-peer banking seems like a natural idea.

One country was left behind in this revolution, and that's Canada. Since the Federal Government mandated that only accredited investors can participate in the funding, peer-to-peer lending (or P2PL) was anything but dead in Canada. What is left for us to do if it is not available here? Going abroad of course.

There is a problem however - most of the P2PL companies like Lending Club or Zopa are focused on their domestic markets and you would need a local ID to register on those. There are also companies like Zidisha which are open to international lenders, but their main focus is not on the profits, but rather on making loans available to those less fortunate in countries where finding affordable credit is problematic.

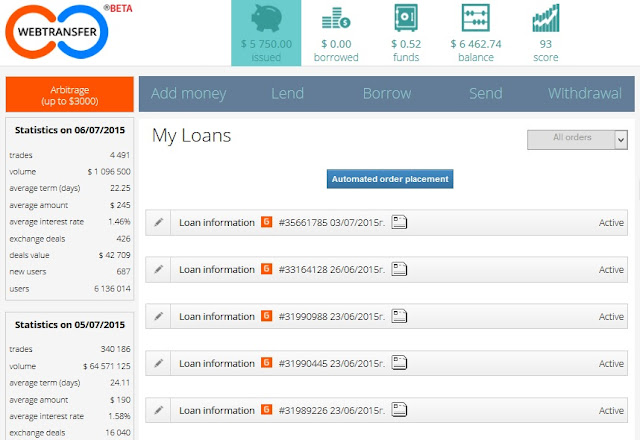

One option that we're left with is Webtransfer Finance. Described as a Social Credit Network, it works much like other P2PL networks that you might have read about on the net. You transfer cash on to your account and give out multiple loans from $50 to $1000 in value and from 3 to 30 days in duration (more on this later). The loans that you make available are automatically matched against the interested borrowers. Matching process takes from minutes to hours. Once the time that you set the loan for expires, you get the money back plus the interest.

One option that we're left with is Webtransfer Finance. Described as a Social Credit Network, it works much like other P2PL networks that you might have read about on the net. You transfer cash on to your account and give out multiple loans from $50 to $1000 in value and from 3 to 30 days in duration (more on this later). The loans that you make available are automatically matched against the interested borrowers. Matching process takes from minutes to hours. Once the time that you set the loan for expires, you get the money back plus the interest.

Interest rates are rather high, since you're dealing with short term loans. You're in the same market here as credit cards and payday loans. As of this writing I normally set out the interest to 1.6% daily. After giving half to the guarantor, you're left with 0.8% daily or 8% on a 10 day loan. That is huge! In fact, when I found out that you can get that much, I started questioning the legitimacy of the whole enterprise and its business model.The borrowers are scanned for credit-worthiness to a degree, but this does not concern you as a lender that much, since Webtransfer acts as a guarantor on the loan. To exercise that you'd have to share 50% of your profit with Webtransfer, but the loan is completely secure. As of the time of this writing there is a dedicated security fund of over $10,000,000 for such guarantees. This particular feature sets Webtransfer aside from other P2PL platforms as the risk of defaults is eliminated.

The company is based in Russia. As of this writing it has been active for more than a year and has over one million members. At the bottom of the website they have a section with media coverage - most of it in Russian. The coverage is from well-respected publication. One of them is from

Alpha Bank - a major Russian bank (you could say a Russian equivalent of Royal Bank or TD), in which it talks about their partnership with Webtransfer. So overall the company appears legit.

The business model seems sound - Webtransfer collects 50% on the interest of most loans (having a guarantor is optional, but I'm sure the vast majority of lenders choose to have one). Some of that income goes to affiliate partners (you can easily become one!), some goes to cover the defaulted loans, but a lot stays with Webtransfer. They are also making a lot on commissions that they charge on transferring cash into and out of the system. Overall it seems like a fairly profitable enterprise and there's no reason for it to shut down.

To sum it all up, it's business model seems sound, there are positive press review from good sources, and there are respectable partners. But it's based in a country which is not exactly a bastion of stability. My personal strategy - same as with other investment, I only invest as much as I am ready to loose. I am also making sure to withdraw the profits often - on a monthly basis in my case, leaving a nominal amount invested. There is risk involved just as there is with any investment, but the gains are hard to just pass by. With $5000 invested, you can make $1200 per month or more - not a bad addition to your income. And in as little as 4 months you can get complete return on your investments, get all your original money out and continue playing only with the money that you have earned.

So how do you go about taking advantage of this opportunity? All it takes is to:

- Set up an account,

- Fund your account,

- Start lending.

How to register

You register in the same way as you do for any other online service. There are a few quirks

along the way (notice the "beta" word at the logo) which we will address in this section.

1. Click

this link to go to Webtransfer website.

2. Scroll down to the bottom of the page and select English from the drop down box.

3. Scroll back to the top of the page, click on the button that looks like an infinity sign (that's actually Webtransfer's iconified logo. If you're not seeing those buttons, make sure your ad blocking plugins are disabled on the page. Register with a username and a password, check the "New user" checkbox, click the register button.

UPDATE: This method of registration doesn't seem to work at the moment, but the other types (social network) seem to work fine.

4. You will receive a notification email, click the link therein to verify your email address.

5. Continue on with the registration form, filling out the required fields and skipping the nonrequired (like "patronymical" whatever that would be). The forms are mostly straightforward, but with a few quirks. They are targeted mostly for Russian citizens and the English translation of the website is automatic and not always correct.

- In "Personal Information" make sure to confirm your Phone through SMS as it is required to continue with the registration.

- "Udostoveryuschy identity document" is essentially your passport. If you enter your Canadian passport, "Series" and "Code division" can be left blank as they don't apply. Date of issue is in dd/mm/yyyy format

- In "Address" - "Index" can be left blank - it's a numeric postal code which does not apply to us. I entered the street address along with appartment number in the "Street" and postal code in the "House", this way the printed address is all in correct order.

- Payment data - this is where you enter the methods for withdrawing funds from Webtransfer. I use my credit card, Paypal, and bank account for wire transfers, leaving the rest blank.

6. Upload the necessary documents - the two that are required are:

- the front page of your passport and

- a proof of your address - this can be any utility bill that has your address on it.

You can take a picture of both with your cell and upload. Just make sure that the files are not more than 1 MB in size.

Once your profile is complete and verified, you are ready to start lending! Once your account is active you automatically receive $50 for free that you can start lending. Make sure to lend them for a maximum amount of time allowed - 10 days, to get the maximum interest. Once the lended amount is returned to you, Webtransfer will withdraw the $50 Bonus that they gave you and you're left with the interest.

Depositing Funds into Your Account

Your next step is to top up your account. The easiest way to do it is through a credit card, but it doesn't seem to work each time. To do that just click on the "Deposit" link in the top menu, and click on the link next to MasterCard/Visa icon.

As you go through the process, you will be redirected to the payment tunnel called LiqPay. You'll be asked for a cell number and will be sent an SMS code for the transaction. Make sure that your credit card and cell phone are both from the same country.

If the credit card method does not work (LiqPay has some daily limits so you don't always succeed) you can add money through a wire transfer. It takes only 2 days for your funds to arrive. It is now suggested that you send a message to the Support indicating that you are about to send a Wire Transfer with a few details - the amount, date and bank account you're sending the money from. This way you can avoid the possible confusion and speed up the process. When I wired the money the first time without messaging the Support, the money didn't arrive for a few days after which I got a call from Webtransfer on my cell, telling me that there are a few users with the same first name and last name as me, and that they couldn't determine who the Wire is for. After confirming a few details over the phone, I got to see the money in my Wallet within minutes.

If you choose "Deposit" from the menu and click the link shown in the picture, you'll get the details of the bank account to transfer the money into.

To complete the transfer you need to log in to your online banking account, and choose "International Money Transfer". These are the details I entered when I did the transfer myself from my Royal Bank account:

Don't forget to email the support, and let them know you're wiring the money!

Currently there is a promotion happening. The more money you transfer in, the more Bonus money you get. What is bonus money? Say you transferred $1000 to your account. Webtransfer will add $400 Bonus. What you can do with those is you can lend them for a maximum of 10 days. At the end of that period, when the loan is returned, those $400 will disappear from your wallet, but you do get to keep the interest earned on that 10 day loan.

Other options for transferring money are also available but they don't seem to be very reliable. They are rather meant for the holders of Russian issued credit cards.

Start Lending!

Once your funds have arrived in your Webtransfer Wallet, you're ready to start lending. To do that, click on the Lend link. You will be presented with a form.

- Choose the amount you want to lend. I would recommend that you create many loans with small amounts of say $100 - $200 per loan. In case a borrower does default on a loan, it may take time for the Guarantor to return the money to you. Splitting loans into small amounts will save you from missing too big of a chunk of your available funds.

- Term - select any duration you wish to lend the money out for. Shorter duration means you'll get your interest faster, and you'll be able to reinvest the interest as well.

- Interest: Try to play with the interest that you request. Try to set it a bit higher and wait for a day to see if someone accepts it. If nobody does, lower it by a point or two. As of this writing as I set the interest to 1.6% it takes 3-4 hours for the loan to find an interested borrower, while 1.5% loans are taken out in minutes. You can use the "Average Interest" in the tab on the left as your guide.

- Make sure that "Guarant" is selected - your return will be guaranteed by Webtransfer

All set - click "Submit" and confirm.

Withdrawing Money

Paypal is the easiest way to get the money out. You do get charged some commission, but it's nothing considering the interest that you earn. Withdrawing is easy, just click the Withdraw link in the menu, choose the amount and Paypal as your withdrawal method. It usually takes a few hours to receive the money on Paypal. As you can see from the screenshots below, last time the payment came from an employee called Alexander Egorov.

Take advantage of this financial innovation -

register and start earning today!